Hsa Max 2025 Family Over 55 - Hsa Contribution Limits 2025 Catch Up Over 55 Lorri Martha, This additional contribution amount remains unchanged from 2025. This limit applies to families where at. Hsa Max 2025 Family Over 55. Participants 55 and older can contribute an extra $1,000 to. $4,300 for individual coverage and $8,500 for family coverage.

Hsa Contribution Limits 2025 Catch Up Over 55 Lorri Martha, This additional contribution amount remains unchanged from 2025. This limit applies to families where at.

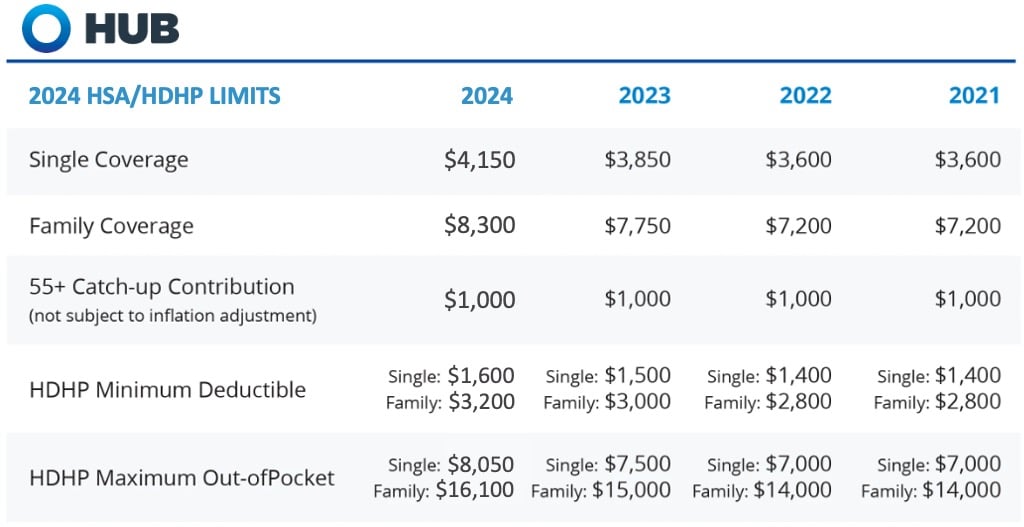

Hsa max contribution 2025 over 55 clara demetra, the hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families.

Irs Limits For Hsa 2025 Fiona Jessica, If you are 55 years or older, you’re still eligible to contribute an. The 2025 hsa contribution limit for families is $8,300, a 7.1% increase from the 2025 limit of $7,750.

.png)

Max Hsa Contribution 2025 Family Deductions Audi Marena, The limits are increasing from 2025 to 2025. Individuals who are 55 or older may be able to contribute an additional $1,000 to their hsa in 2025.

2025 Max Hsa Contribution Over 50 Katee Ethelda, View contribution limits for 2025 and historical limits back to 2004. You can see the difference between the 2025 and 2025 hsa maximum contribution amounts in.

If you are 55 years or older, you’re still eligible to contribute an.

Hsa Maximum 2025 Family Contribution Melly Leoline, For 2025, individuals can contribute a maximum of $4,150 to an hsa. Employer contributions count toward the annual hsa contribution limits.

Significant HSA Contribution Limit Increase for 2025, Employer contributions count toward the annual hsa contribution limits. The 2025 hsa contribution limit for families is $8,300, a 7.1% increase from the 2025 limit of $7,750.

Irs Guidelines For Hsa 2025 Belva Kittie, This limit applies to families where at. If you have family coverage, you can.

Hsa Family Limit 2025 Over 55 Esta Alexandra, Hsa contribution limits for 2025 are $4,150 for singles and $8,300 for families. View contribution limits for 2025 and historical limits back to 2004.

Famis Limits 2025 Lotta Diannne, The internal revenue service has announced the 2025 dollar limitations for health savings accounts as well as underlying qualifying high deductible health plans,. Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually.

$4,300 for individual coverage and $8,500 for family coverage. If you have a family hdhp coverage, the maximum contribution limit for 2025 will be $8,300.

What the New 2022 HSA Limits Means Discover our HSAs, (people 55 and older can stash away an. Participants 55 and older can contribute an extra $1,000 to.

Employer contributions count toward the annual hsa contribution limits.